We hear it all the time…on the golf course, out at dinner with your friends, over coffee with peers:

“How are your investments doing???”

“I made 20% this year”

“I bought [insert random stock] this year and am making a killing!”

With over 20 years of experience managing portfolios for clients, there is no shortage of hot investment ideas to discuss, but I hate to let you down here, that is not what I am going to go over today. I have seen it all too many times, someone brags about how well they are doing one year, only to let you know that they took a massive drop within a couple years and the emotional roller-coaster goes around another loop. Many investors end up giving up (and usually at the worst time) and sell everything off to go to something more “safe.”

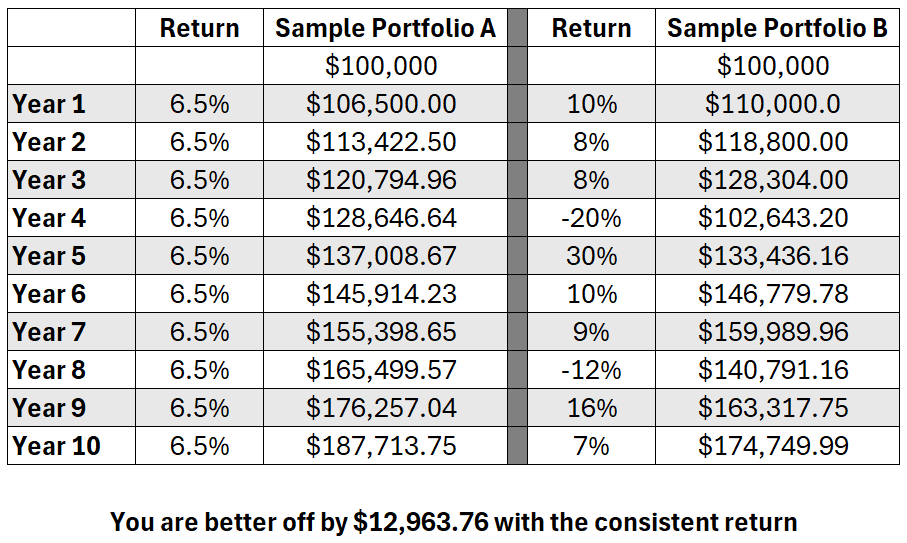

If there is one thing that I have learned over the years, it is to create a properly diversified portfolio, with different asset classes that perform in different ways and at different times. The point here, is to win by not losing. If we can smooth out portfolio returns, not only do we end up in a pretty good place, but we also save ourselves a bunch of heartache along the way. I am attaching a sample set of returns for two portfolios to get the point across. In my example, we start with $100,000 and see a set of returns for 10 years. In Portfolio A, we achieve 6.5% every year for the 10 years while in Portfolio B, we have a much more varied set of returns, with very good positive years in 8 of the 10 years, with 2 negative years along the way. When I input the numbers, my goal was to see where things would end up after 10 years. I randomly chose the return schedule and the only thought in my head was that I wanted the lowest positive year in Portfolio B to be higher than the return in Portfolio A.

Once I created the return schedule, I asked a few clients which portfolio they thought would be better after 10 years. The common answer that I got was something like “JP, Portfolio B sounds better overall, but I know where you’re going with this!”

As a CFP Professional and Investment Advisor, building financial plans that ensure clients hit their goals is the primary priority of what we do. By building proper portfolios, not only do we stand a better chance of hitting their targets over time, but we also give them a much better chance of staying the course on the way there. At Harbourfront, we use “Pension Style” asset management to give our clients access to a broad array of asset classes to ensure smoother returns and fewer sleepless nights.

Let’s chat!

JP